See This Report about Broker Mortgage Rates

Wiki Article

Things about Broker Mortgage Calculator

Table of Contents9 Simple Techniques For Mortgage Broker Average SalaryThe smart Trick of Broker Mortgage Calculator That Nobody is DiscussingOur Broker Mortgage Calculator PDFsBroker Mortgage Meaning Can Be Fun For EveryoneUnknown Facts About Broker Mortgage RatesEverything about Broker Mortgage MeaningThe Main Principles Of Mortgage Broker Job Description Broker Mortgage Rates - Truths

What Is a Home mortgage Broker? The home loan broker will certainly work with both parties to obtain the private accepted for the loan.A home loan broker typically functions with many different loan providers and also can provide a selection of car loan alternatives to the debtor they function with. The broker will certainly accumulate details from the specific and also go to several loan providers in order to locate the ideal possible loan for their customer.

The Ultimate Guide To Broker Mortgage Fees

All-time Low Line: Do I Need A Home Loan Broker? Dealing with a home loan broker can conserve the customer time and also effort throughout the application process, and potentially a great deal of money over the life of the financing. In addition, some lenders work exclusively with home mortgage brokers, indicating that debtors would have accessibility to financings that would or else not be readily available to them.It's essential to analyze all the charges, both those you may need to pay the broker, as well as any kind of fees the broker can assist you avoid, when considering the decision to work with a home mortgage broker.

Not known Factual Statements About Broker Mortgage Near Me

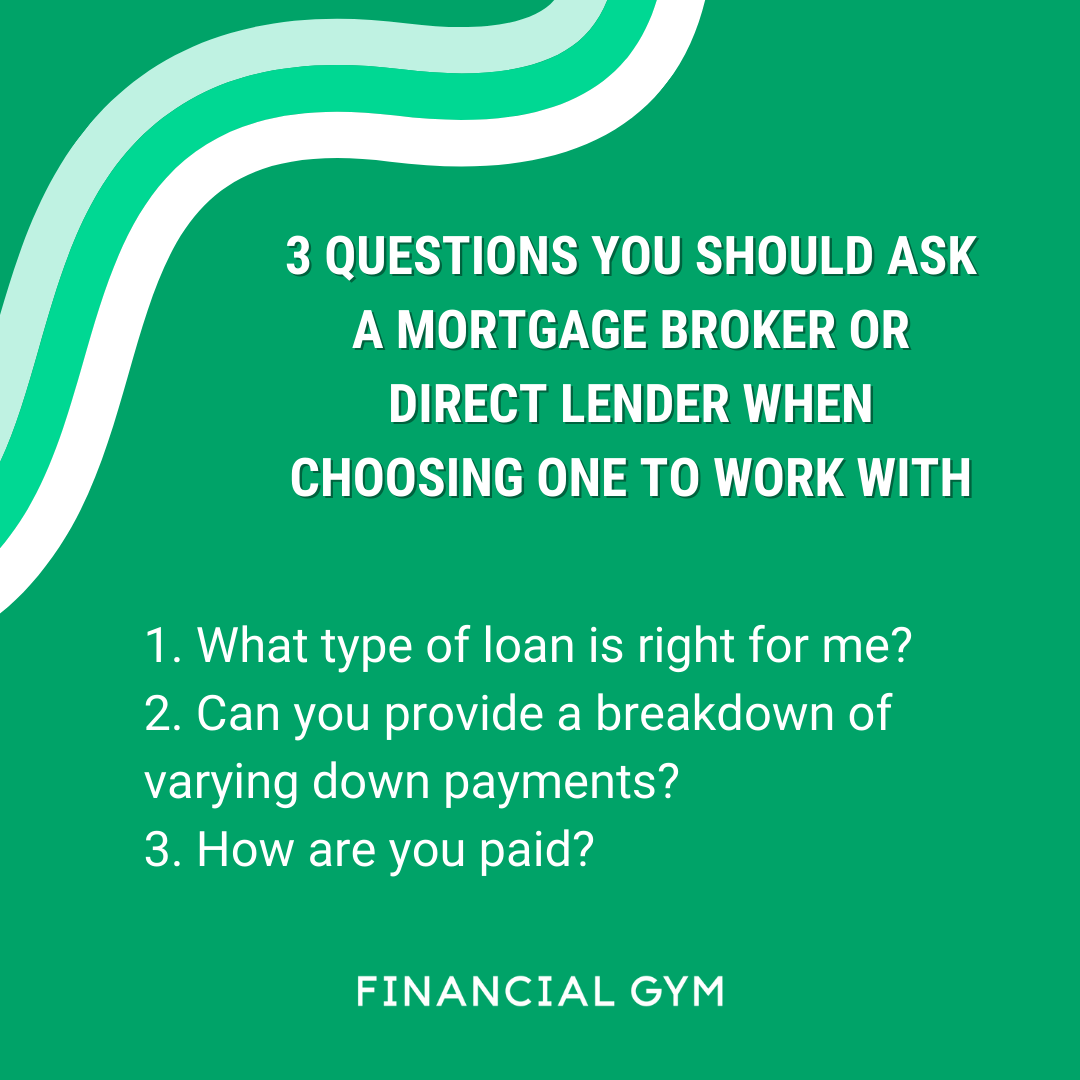

You have actually probably heard the term "home loan broker" from your property agent or good friends who have actually acquired a house. But exactly what is a home loan broker as well as what does one do that's various from, say, a loan police officer at a financial institution? Nerd, Purse Guide to COVID-19Get response to concerns concerning your home loan, traveling, finances and keeping your assurance.1. What is a home loan broker? A home loan broker works as an intermediary in between you and also prospective lenders. The broker's task is to compare home mortgage lending institutions in your place as well as discover passion prices that fit your demands - mortgage broker association. Mortgage brokers have stables of lenders they deal with, which can make your life easier.

The smart Trick of Broker Mortgage Rates That Nobody is Discussing

Just how does a home loan broker earn money? Home loan brokers are frequently paid by lenders, in some cases by borrowers, but, by legislation, never both. That legislation the Dodd-Frank Act also bans home mortgage brokers from charging concealed charges or basing their payment on a debtor's rate of interest. You can also choose to pay the mortgage broker on your own.The competitiveness and also residence costs in your market will have a hand in determining what home loan brokers cost. Federal legislation restricts how high settlement can go. 3. What makes mortgage brokers various from financing officers? Finance policemans are employees of one lending institution that are paid established wages (plus rewards). Finance police officers can write just the kinds of fundings their company chooses to provide.

The Of Mortgage Broker Assistant Job Description

Home mortgage brokers may be able to offer customers accessibility to a broad choice of lending types. You can conserve time by utilizing a home loan broker; it can take hours to apply for preapproval with various lenders, after that there's the back-and-forth communication included in financing the financing as well as guaranteeing the deal remains on track.When why not try these out selecting any type of lender whether through a broker or directly you'll desire to pay attention to lending institution fees." After that, take the Finance Price quote you get from each lending institution, position them side by side and also contrast your rate of interest price as well as all of the charges as well as shutting expenses.

Top Guidelines Of Mortgage Broker Assistant Job Description

5. Just how do I select a home mortgage broker? The most effective means is to ask close friends as well as loved ones for recommendations, yet see to it they have really used the broker and also aren't simply dropping the name of a former college roommate or a distant colleague. Learn all you can regarding the broker's solutions, interaction style, degree of knowledge and technique to customers.

The 10-Second Trick For Mortgage Broker Salary

Competitors and also home costs will certainly affect just how browse around this web-site much home loan brokers get paid. What's the difference in between a home mortgage broker and also a loan police officer? Lending police officers function for one lending institution.

3 Easy Facts About Mortgage Broker Vs Loan Officer Shown

Investing in a broker mortgages new house is just one of the most complicated occasions in an individual's life. Quality vary greatly in terms of style, amenities, school district as well as, naturally, the always essential "place, place, area." The home mortgage application procedure is a difficult aspect of the homebuying process, particularly for those without previous experience.

Can establish which concerns might create problems with one loan provider versus an additional. Why some customers stay clear of mortgage brokers Occasionally buyers really feel much more comfortable going directly to a huge bank to protect their financing. Because instance, customers need to at the very least consult with a broker in order to comprehend all of their alternatives regarding the type of funding as well as the offered rate.

Report this wiki page